Plenty of data from the UK this week. For the third month in a row inflation was broadly in line with the Bank of England’s longer-term targets. 3-month annualised core inflation (which excludes food and energy) is now 2.8% for the UK. This is within 1% of the Bank of England’s 2% target and exactly the same as the US 3-month core inflation rate. (US inflation generally looks to be much more under control than in the UK by the way). It is good to see UK inflation data normalising after a nasty 18 months. We were not surprised to see that the Bank of England chose to keep rates on hold on Wednesday and our best guess is that peak for UK rates is in at 5.25%.

However, the challenge for the UK is continued strong wage growth which is still running at over 8% (and rising). 8% wage inflation is just not consistent with 2% core inflation (the wage number you would like to see is probably more like 3% to 4% p.a.). The US has been able to achieve falling wages without a material rise in unemployment. The optimistic case is that the UK and Europe is just following the US’ inflation experience but with a lag caused by the Ukraine energy price shock. This would mean wage inflation would slowly follow core inflation lower with a need for rising unemployment.

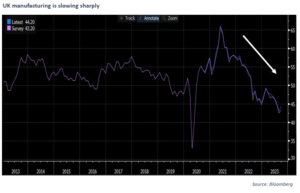

There are a couple of challenges to this more optimistic take on the UK. The first is that rising interest rates may slowly be starting to hit activity in the real economy. PMI data came out today for the UK. These are forward looking surveys that ask companies whether various parts of their business are getting better or worse. Below 50 is consistent with a slowdown. The composite number fell from 48.6 to 46.8. The number for manufacturing is 43.0 which is very recessionary.

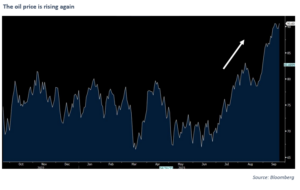

The second challenge is the resurgence of oil price inflation. Saudi Arabia have cut production in order to push the oil price back up closer to $100 a barrel. Normally, central banks and economists would look through this sort of supply driven commodity inflation (it is more like a tax rise for consumers than an indication of an economy that is running too hot). But, given the experiences of the last 18 months, they would be wary of higher inflation becoming ingrained into consumer and corporate expectations. If nothing else, it will be harder for central banks to cut interest rates if energy drives headline inflation rates higher over the next few months.

So far in 2023 markets and the economy have been able to walk the tightrope of slowing inflation without pushing the economy into recession. There is a path for the UK economy to continue to be able to do this for the next 12 months. The good news is plenty of markets (including UK equities for example) are already priced assuming a slowdown is on its way so there will be upside for your returns if we can continue to avoid a nasty recession. The bad news is that, as we discussed above, plenty of challenges remain along the way. They say short term paranoia combined with long term optimism makes for a good investor. My gut is this will continue to be true over the next 12 months.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.