One thing about markets is that they train you to slowly ignore things that on the face of it look very strange. Then, once you’ve got used to the strangeness and start to think it all looks very normal, markets mean revert back to where they should be in short order. The most obvious example of this for me was after 2008 when interest rates went to zero. For a long time this was treated as an anomaly and people just assumed they’d rise again. Slowly, slowly it became the norm (Japan had kept rates low so why not us?). Then came Covid, the re-opening boom and, in just 18 months or so, we were back to 5% bank base rates again.

I mention this because I feel like a similar phenomenon is happening with UK equity valuations. I talked to a couple of UK equity managers last week and they were both staggered by some of the cheap prices they saw. Part of this is, of course, the market just being rational. Equity investors ultimately look for growing earnings and there hasn’t been much growth recently in the UK – nearly all the excitement has been in the US.

A second reason is that UK savers and pension funds used to buy more UK equities. Personal equity plans (or PEPS, which then turned into ISAs in 1999) were originally only allowed to invest in vehicles that had half their money invested the UK. Pension funds also had large UK equity allocations. This has all changed. ISA rules have been relaxed and most pension funds now invest globally. The UK today is about 3% of global GDP and 3.9% of global equity markets. Many UK investors have been lowering their UK equity allocations to bring them closer to these market weights. Money has been slowly exiting the UK. The impact of all this on valuations you can see in the chart below.

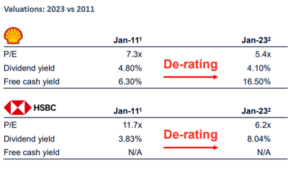

This has created some valuations that, on the face of it, look strange to me. We have a major UK banking franchise trading at 3.9 times this year’s earnings. It pays a 6% dividend and is buying back a similar amount of stock so there is a 12% total cashflow yield for investors today. You’d have to be very bearish large banks not to find this an attractive place to invest some money. In a similar vein, here are the valuations of Shell and HSBC compared to where they were in 2011:

One thing you learn early on as an investor is there is almost no correlation between today’s valuations and your subsequent 12 months’ returns. So, in the short term, cheapness doesn’t help much. It does, however, give you a sense of the upside if things start to move your way. And there really does look to be a lot of upside available should sentiment swing back to the UK equity market.

One glimmer of hope is the chancellor’s Autumn Statement coming up later this month which has been rumoured to try and encourage UK equity investment (as Nigel Lawson’s original PEPs did of course). Otherwise, UK investors may continue to need (even more) patience. The good news, however, is that with some of the dividend and share buyback yields on offer today, at least our patience is starting to be rewarded.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

Chris Brown

CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.