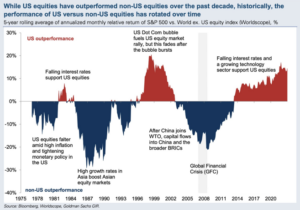

10 years is a long time in this business. And for the last 10 years the US has outperformed the rest of the world handily. In 2023 this outperformance continued as the so-called Magnificent 7 US technology giants gained over 90% for the year. There are a couple of obvious tensions here though. First, US out-performance has not always been the case – as the chart below shows the S&P 500 has in fact under-performed more than it has out-performed since the mid-1970s (thanks to Goldman Sachs for putting this together).

There is also the challenge that after such a strong run in 2023 US tech valuations are back to looking expensive. At the start of 2023, Amazon and Meta (2 of the Magnificent 7) were trading below their Covid lows. Amazon then returned 81% in 2023 and Meta gained a staggering 195%. Meanwhile, Microsoft’s p/e multiple was 21 at the start of 2023 (down from 26 at the start of 2022). Today clearly we are in a very different starting place. Microsoft’s forward p/e is 34 – the highest it has been in recent history. Generally speaking, it’s harder for big companies to grow faster than smaller ones. Microsoft’s market cap is $2.9trn and multiple of 34 means investors expect there is plenty more growth to come.

Higher valuations are also combined with generally more positive sentiment and outlooks from the investor community. Optimism today gives more scope for disappointments to move prices lower tomorrow. But there are two comforts here before we all get too gloomy. First, valuations for the rest of the world remain very reasonable and – for much of the UK and Europe – are downright cheap. For the UK in particular my instincts are if the economy holds up again in 2024 we should have another decent year for equity returns.

Secondly, there is a good reason that that the investor community is more optimistic and that is that the economic outlook remains solid. The story of 2023 was that the US economy (and most of the developed world) was remarkably strong in the face of the higher interest rates and geopolitical shocks that were thrown at it. I wouldn’t bet against this happening again in 2024. And if it does, the odds of a positive year for equities are heavily in your favour. To illustrate this here are the 1 year returns for the US S&P 500 index during economic expansions.

At some point the economic strength of the US and their lead in software and technology will become fully priced-in to markets. This will give room for other parts of the world to finally out-perform again. My instincts are that next 10 years will be different to the last 10. NTT, Bank of Tokyo, Industrial bank of Japan, Sumitomo, IBM and Exxon were all in the top 10 most valuable companies in the world in 1990. The 2010s saw Petro China, ICBC and China Construction Bank make this list.

It is remarkably hard to become dominant and then keep on growing. That said, the US tech giants have done an extraordinary job of this so far. In the short term, it would seem foolish to bet against that continuing and – full disclosure – at IPS we are not doing this. We have a decent allocation to US large cap tech in our portfolios which we balance with (cheap) UK and Europe. But at some point market leadership will change again. It goes without saying that when this happens we will be doing our best to make sure we are on the right side of the change.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.