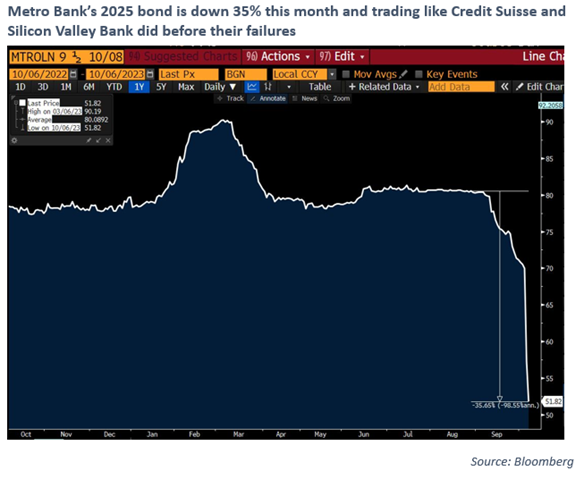

I wrote our quarterly outlook piece this week which covered the major markets we invest in (equities, fixed income and alternatives) and how they look after one of the fastest interest rises in history and the opportunities we see today. If you are not a client and would like to receive it please do get in touch. My other public service announcement is that, as I write on Friday 6th October, Metro Bank is looking very much like Silicon Valley Bank and Credit Suisse did the week before they failed. I am not close to Metro Bank (it is small, we have no links to them), but I personally wouldn’t have more than £85,000 with them (the maximum amount protected by the FSCS).

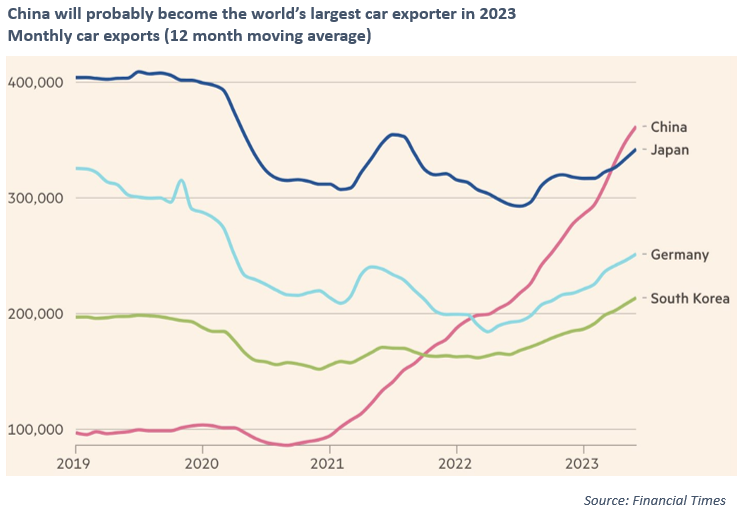

Instead, this week here are a couple of thoughts on the enigma that is China. It remains the worst performing major market we look at and is now down over 20% from its January highs. There was no Covid re-opening boom like the one we saw elsewhere, and the property debt overhang continues to be a major drag on the economy (as it was for Japan in the 1990s, of course, and for much of the west post-2008). And yet China remains a leader in a couple of key growth areas. First, electric cars. China looks like it will become the world’s largest car exporter this year.

And yet part of this growth has come from heavy government subsidies and financial support for the Chinese car industry. How will the Europeans feel when cheaper Chinese cars start flooding in which have benefitted from the sort of government largesse that is now forbidden in the EU? The deglobalisation tensions that have held back Chinese growth and equity markets don’t look like they will be slowing down any time soon.

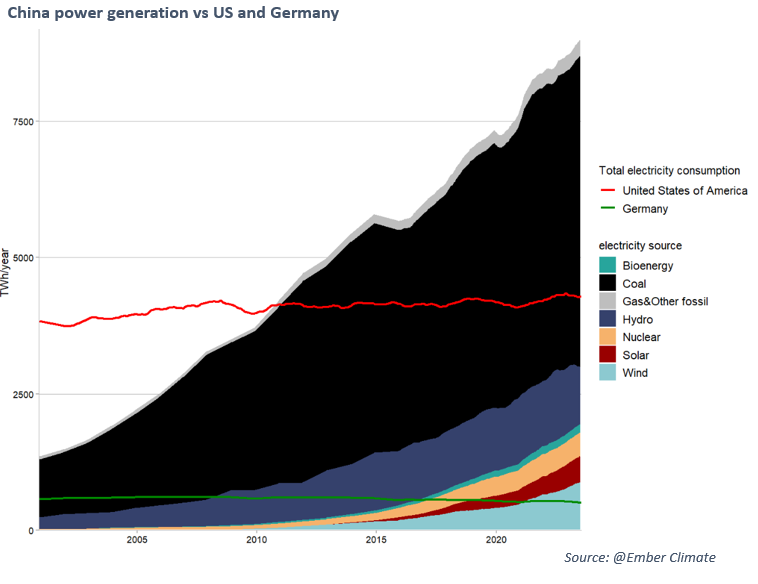

The second huge China success story that also has plenty of red flags is in energy. Cheap Chinese solar panels are the main reason that solar energy production is now, at the margin, the cheapest source of energy production for many markets (including the UK). This is a great news for climate change: there is now no real trade-off between lowering carbon emissions and higher energy prices. There’s just a whole lot more work to do. China also now produces more wind energy than the total energy consumed by Germany. Its total renewable energy production should surpass the US entire energy consumptions levels in around 5 years (see the chart below).

And yet you can also see the huge growth in the black part of the chart which shows coal consumption. China’s energy needs are so huge that it is at once the biggest force behind cost effective renewable energy and the world’s fastest growing polluter. China remains both the problem and the solution.

China has always been one of the biggest enigmas to me as an investor. It is 16% of global GDP growing at around 5% per annum, with a lead in many growth industries (including many very innovative technology companies). And yet it is still officially a communist country where it is never that clear who really owns what and it is being weighed down by a Japanese style property bust. That means it remains cheap. But it has not become cheap enough for us this year. That said the lure of all the opportunity that is on offer remains strong.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them here too.

Chris Brown

CIO

IPS Capital

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.