I was sent a client question this week: who will be better for my investments Biden or Trump? This is a good question because there, I think, are a couple of sensible things you can say about it today. It is also a better question than who will win the US election: Biden or Trump? Early on in this job you learn that some events can be both very important, heavily analysed and discussed but also fundamentally unknowable. US elections (which are always close) are like that (as was the result of the Brexit referendum). All I can say is that the US economy has survived both Trump and Biden pretty well over the last 8 years so I wouldn’t bet against it happening again for the next 4.

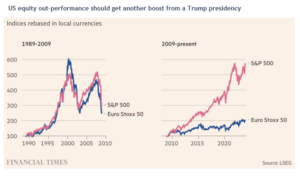

But the question was would Biden or Trump be better for investors? Here I think the one thing you can concretely say is that Trump is planning a 10% tariff on most imports and a 60% tariff on Chinese ones. If he wins then I think this (or something like it) will come into force. I have talked here before about the relative out-performance of US vs European equities. Import tariffs would hit European exporters (especially Germany). A Republican presidency would be likely to be more pro-business with, at the margin, a more friendly tax and regulatory environment. I have written before about the last 15 years of US equity market exceptionalism and how this wasn’t always the case (see the chart below which compares 1989-09 to the period after 2009). If Trump does win the election, I would expect US exceptionalism to keep running a little bit longer.

The other point I would make is that tariffs are often less effective from an economic perspective than the initial headlines might suggest. One reason for this is the use of middlemen countries (e.g. China exports to Turkey which, after a few small alterations, then exports on to the US). The other is that currencies usually adjust pretty quickly to the new reality. After Brexit, sterling became cheaper in part to entice investors back into the UK. After Trump’s first China tariffs the Chinese Renminbi (RMB) also fell for similar reasons. So although tariffs pushed the cost of Chinese goods up, a weaker RMB meant this effect was less than it otherwise would have been. I would expect a similar effect for the Euro (and other non-USD currencies) on a Trump victory. So more dollar strength.

US exceptionalism has already made it a lot more expensive for Europeans to visit the US. If you think Trump will get in and you want to visit America next year, you might want to book that holiday now.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.