I wrote last week about how we weren’t – even with rates at 5% or more – putting much cash on deposit for clients. For those that missed it, our logic is that if it is yield you are after, you can get more on short-dated high-quality credit (7% or so today) without taking on too much extra risk. On the other hand, if and when a recession does arrive, there should be some good capital gains available in the government bond market on top of today’s 4.6% yield. Either way, there look to be better alternatives. Still, 5% on cash is still pretty tempting and – if the markets are right – this will be 6% by the end of the year. How long are these sorts of yields likely to be around?

The first point is that forecasting UK inflation and interest rates has been particularly hard. The Bank of England, whose job it is to do precisely this, completely missed the inflation risk in 2021 (when it would have been helpful to start to act on it).

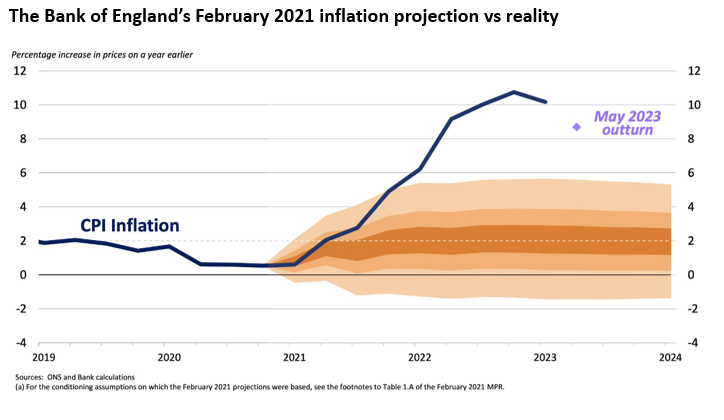

To illustrate this, below is a fan chart produced by the Bank of England in 2021 to show what they thought the range of possible inflation outcomes was looking forward. The lighter shaded range shows the lower probability outcomes and the way this chart works you should be inside the shaded range 95% of the time. The darker line is what actually happened.

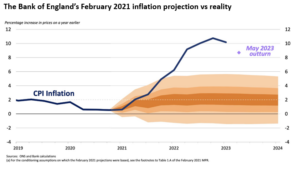

Part of the lesson here is forecasting is hard and, for whatever reason (Brexit? Russia?), the UK is harder to forecast than other major economies. With that proviso, how likely is inflation to fall from here? There was a crumb of comfort this week from June shop price inflation, which after a period of sustained rises fell back to historically more normal levels in June.

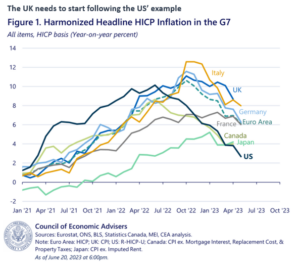

Still, wage inflation remains strong and, as petrol and energy prices fall, there is no reason for UK consumer demand to weaken. The optimistic case is that we follow the US’ example (with a lag), where we have seen wages moderate and inflation fall without seeing any real economic slowdown.

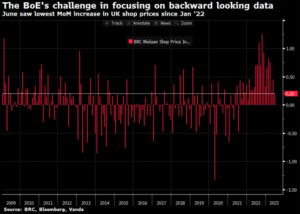

On plenty of measures, if you replace (lagging) US housing measures with something more up to date, then core inflation is back in line with the Fed’s 2% target (one calculation of this from Wisdomtree is below). This sort of immaculate disinflation was thought to be more or less impossible back in 2022 yet, once again, the forecasts were wrong and the US looks to have pulled it off.

6% base rates will cause plenty of pain to the (minority of) people who own a home with a floating or short-term fixed rate mortgage. The hope for these borrowers is that the UK follows the US experience but with a lag. My final chart gives some hope that this might indeed be the case. The lag looks to be around 1 year. If this is right then the two opportunities I mentioned at the start (high quality corporate credit and UK government bonds) should generate some pretty attractive returns over the next 12 months. I for one am hoping that we see less UK exceptionalism over the next couple of years.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.