The headline of my piece last week was “The US will not out-perform forever”. Headlines are of course designed to get people to read, but equally I didn’t think it was too bold a statement (nothing is forever!). That said, I got more pushback from readers last week than on anything I have written recently. So, this week I thought I’d add a couple of qualifications to last week’s note that I probably would and should have added if I had more space. Finally, a year or so ago I wrote why it was good to be 52. As I am now 53, there is an update on this important topic at the end.

On the US, my first concern is that last week’s note might have sounded like sour grapes from someone who doesn’t have much US equity exposure or own much of the Magnificent 7. I don’t think this is actually the case. Whilst we remain deliberately diversified in our equity book, around half of our equity exposure is in the US for our sterling clients (and the number is generally higher for our non-sterling investors). Of this, this vast majority is in passive vehicles which naturally have a full allocation to the Magnificent 7 large cap equity stocks (currently 27% of the S&P 500). The point of last week was more to force myself to think about a world where US exceptionalism came to an end than to comfort myself that one day we would be proved right.

The second point is – will the US continue to be defensive in a sell off? If it does, then it will earn its place in our portfolios. And the answer – for the first three weeks of the year at least – looks to be yes. 2022 was a bad year for US equities and a terrible one for the technology heavy Nasdaq. One theory behind that was that technology (and high growth companies more generally) do not like higher interest rates. There was some logic to this. A lot of high growth companies lose money today in the hope of making a lot of money in 5 years’ time or more. As interest rates go up, the value of profits expected to be made at some distant time in the future mathematically goes down. So technology companies (just like government bonds) lost a lot of money as interest rates rose in 2022.

What is interesting to me is that this correlation broke down in 2023. Interest rates continued to rise for the first 10 months of 2023. This time however, the Nasdaq gained 32% and was the best performing major market.

This is in sharp contrast to small and mid-cap companies which struggled for most of 2023. In fact, today US technology looks to be more of a safe haven from rising interest rates. Small and mid-cap companies generally have more borrowing and look more geared to the business cycle. If your worry is that inflation stays high and rates have to stay high to combat it, then US technology might be a safe place to hide. The year so far has had that flavour and US large cap technology has continued its outperformance. Nvidia has added $200bn to its market cap this year alone. This is larger than the market capitalisation of Shell, the UK’s largest company!

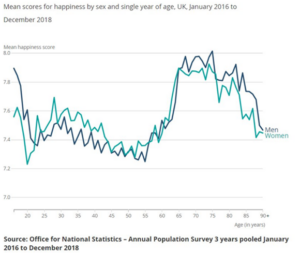

Finally, I have long been interested in the so-called happiness smile. This is the idea that you are most content as a teenager and then again in your old age. I was particularly struck a year ago by some US research that suggested – at 52 – I was finally on the steep upslope to a happy old age. You can imagine my concern this week when I saw the data for the UK (see the chart below). It looks like the real journey to the sunlit uplands starts in your early sixties for us Brits. I worry that this good news might be, like waiting for the rest of the world to out-perform, always a few years away for me. We shall see which change ends up happening first.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.