Google, Microsoft, Amazon, Apple and Meta all reported earnings this week. The results were, on balance, pretty good. And this is in spite of all the expectation and optimism built up for these companies over the last 12 months. The S&P 500 is on track for its 13th up week out of the last 14 (an historically good winning streak). This kind of upwards momentum often ends with short, sharp momentum reversals and 5% to 10% falls are pretty standard yearly events for equity markets. But, if the economic backdrop remains strong (as it is today) then I suspect any pullback won’t last long.

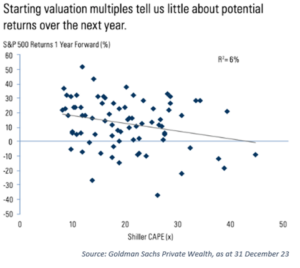

It is also worth remembering that if your time horizon is the next twelve months then the fact that the US is expensive on a headline price/earnings ratio basis is not a good reason for not owning it. There is very little correlation with starting valuations and subsequent 12 month returns. The chart below uses a longer-term valuation measure (the Schiller CAPE ratio) which I won’t get into here but the point stands for more standard valuation measures.

I wrote last week about the strength of recent US and UK economic data. There is still no sign whatsoever of what was, 12 months ago, the most anticipated recession ever. In fact, if anything, you would worry that the economy is running a bit too hot today. Survey data continues to improve in the US and the Atlanta Fed’s estimate of Q1 2024 GDP is running at over 4% annualised.

Given all this, one of the big mysteries to me remains the continued weakness in the office property market. Boston Properties bought out its partners in a New York, Park Avenue South office building for $1 this week (this was originally a $71m investment for them).

And office vacancies remain at all-time highs. I am old enough to remember the 2008 crisis as well as the property-based recessions of the 80s and early 90s. The fact that today’s office vacancy rates are above those levels with US unemployment below 4% and back-to-the-office campaigns in place for most large companies is amazing to me. The working habit changes that Covid brought look to be larger and more permanent than I would have guessed a couple of years ago.

And remember this is just the revenue side of an office investment. Your funding costs have also risen hugely both because of today’s higher interest rates and because banks can see those higher vacancy rates just as well as I can. Lending on offices will be harder to get and, when it is available, much more expensive than in the recent past.

Just in case there are any IPS clients that have made it this far, I am pleased to be able to say that we have a pretty material exposure to US equities and almost no exposure the office property markets. Even with valuations getting cheaper by the day for offices and more expensive this week for US equities, I don’t see that changing any time soon.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.