Why is inflation so much higher in the UK than it is in Europe? This week I give two answers to that question (one which is probably OK for UK investors, one bad) and I end with a reason to ignore all the doom and gloom and stick with the UK anyway. So something for everyone.

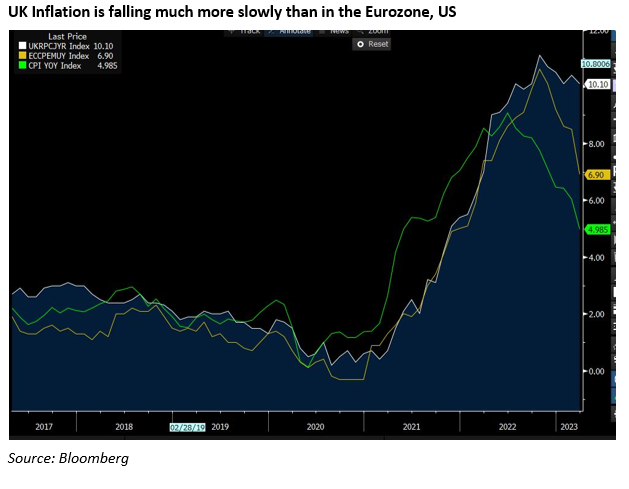

First, the problem. UK CPI inflation is still 10.1% in the UK compared to 6.9% in Europe and 5.0% in the US. Eurozone and US inflation is also falling sharply – as you would expect given Covid supply disruptions are more or less over – whereas this is just not happening in the UK.

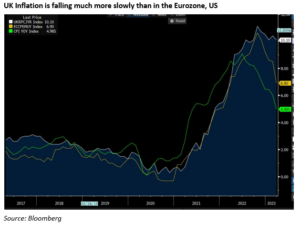

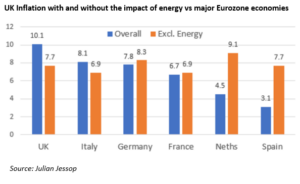

Why is this? The first answer is energy. The UK government forced businesses to bear nearly all the brunt of the energy price rises we saw last year. This compares to more generous support packages offered in much of the Eurozone. This means energy price rises show up more in UK inflation numbers than they do in Europe (and the energy independent US does not really have this problem at all of course). Julian Jessop of the Institute of Economic Affairs has run the numbers and shows that, after adjusting for different energy policies, UK inflation is in fact in line with the other major Eurozone economies.

One way to think of this is higher energy costs for the UK are a bit like a tax rise. The UK government could have shielded us more from rising energy, they didn’t, and this is showing up in the inflation numbers. I understand the reasons for choosing this option. This policy effectively forces businesses to become more energy efficient and incentivises investment in alternative energy sources like renewables. Today’s short term pain should be tomorrow’s gain.

But, from a Bank of England’s perspective, this is exactly the sort of price shock you should look through. Wholesale energy prices are continuing to fall and eventually this will show up in falling UK inflation without the Bank of England needing to raise rates. And higher energy prices mean businesses and consumers have less money to spend elsewhere which is, ultimately, deflationary.

However, the other problem the UK faces is higher wages. When we left the European Union we lost the ability to suck in cheaper workers from the rest of Europe when the economy started to pick up. The cost of the loss of this flexibility is showing up today in the labour market. Here is UK wage inflation compared to the US and Europe.

UK wage inflation is too high and needs to come down. The one reliable way to do this is to raise unemployment by raising interest rates. This puts the Bank of England in a real bind. Some of the inflation we see today it needs to react to, some it needs to ignore. How aggressive they need to be to combat today’s high inflation is a very tricky decision.

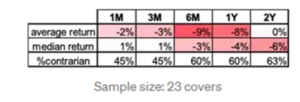

The temptation here is, of course, to look elsewhere for opportunities while the UK sorts its specific issues out. I wrote last week about Economist magazine covers often marking the peak of a trend and so doing the opposite of what the cover would imply. Well, the trend for the last 12 years has been to forget about the UK and just invest in the US. Here is last week’s Economist cover:

And here is the asset performance after a bullish magazine cover:

Maybe it really is time to stick with the UK after all! For the less brave, Europe and Emerging Markets have similarly attractive valuations on offer with fewer of the specific challenges the UK faces. This is indeed where we have been adding this year but I can’t help feeling that the true contrarian play is – thanks to the Economist –long the UK. We shall see.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.