Last weekend OPEC met and Saudi Arabia announced an oil production cut of 1m barrels per day. This is on top of a 2m barrels per day OPEC production cut last October and a further 1.6m barrels per day cut by the Saudis in April. And yet oil is cheaper than it was last October, last April and even last week. What is going on here?

I wrote a lot last year about the war in Ukraine meaning higher energy costs for everyone. Now I think it’s time to write that the Russia’s war means cheaper oil, even for the West. Why is this? OPEC is a cartel that tries to limit supply to keep prices stable and higher than they would be otherwise.

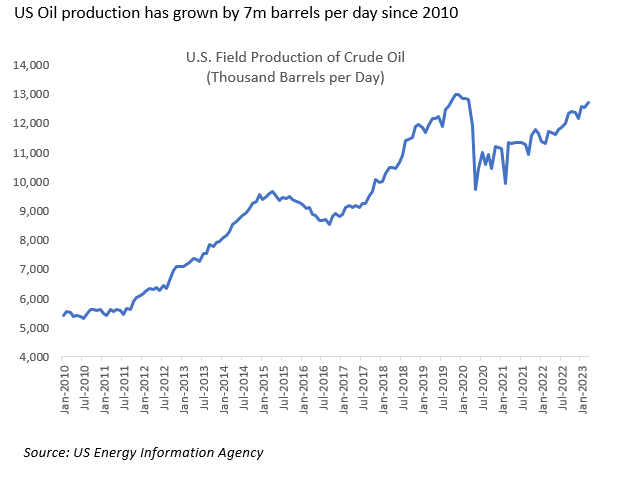

Two things have undermined the power of the OPEC cartel. Firstly, US oil production has grown by over 7m barrels per day since 2010 and it is now a larger producer than even Saudi Arabia. It has also been recovering strongly from its Covid lows.

Secondly, we have Russia. The OPEC cartel is effectively controlled by Saudi Arabia. If countries do not play ball it can (and has) flooded the market to lower prices and punish non-compliance. As the lowest cost producer, it can continue to make money even at these lower prices so this is a credible threat that enforces some discipline.

However, Russia is at war and needs all the money it can get right now. It is pumping all it can, to hell with the cartel. The west has also imposed a $60 price cap on its oil. Why would China or India (its main customers today) pay any more than this? This is effectively a reverse OPEC: a cartel of buyers are controlling part of the market. A desperate producer is producing all it can and the OPEC cartel has lost control. For consumers and car drivers at least, this is some good news.

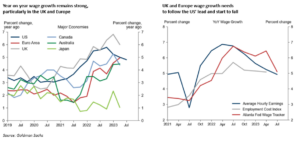

The other side of the inflation story is wage growth. Here the data continues to be more mixed. The US is making good progress but wages look stickier in Europe and (in particular) in the UK. As a result, UK interest rates are now forecast to hit (almost) 5.5% in the second half of the year. If I have some good news for mortgage borrowers you can be sure I’ll be mentioning it here. However, we need to see better wage growth data in Europe. The hope is it will eventually follow the US data down. But until it does, the pressure will stay on the Bank of England and the ECB to keep raising rates.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.