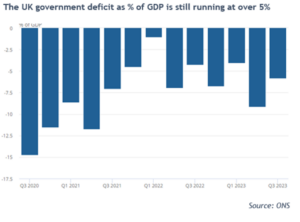

One question I asked in my overview for clients of the first quarter of the year (available, as always, on request) was how growth has remained so strong even after all the recent interest rate rises. Part of the answer is, I think, that I, and plenty of other investment professionals, have not paid enough attention to the fiscal (government spending) side. Yes, interest rates went up, but government deficits were over 10% of GDP in 2020 and are still running at over 5% today. This extra spending matters! Interest rates are restrictive but government fiscal policy is not. Putting the two together the effect looks to be pretty neutral to me if you look at the performance of the global economy today.

I mention this because the country with the most extreme fiscal position is Japan. The Yen has also been extremely weak recently, losing around one third of its value versus the US dollar since the end of 2020. Interest rates are still at zero in Japan. The way markets (and currencies) work is that Japanese assets need to be cheaper to compensate for this. You can either earn 5% in a more expensive currency at risk of devaluation or 0% in cheaper Japan. As ever, currencies adjust to make obvious decisions look harder.

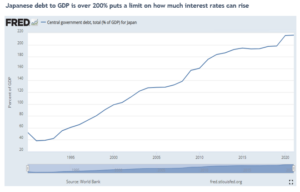

I am loathe to get into longer term currency forecasts but going long the Yen on the idea that it must re-price stronger at some point has been a popular trade. But it has also been wrong. Part of the reason for this is, of course, that there has been no real economic crisis for the last 18 months that has forced Japanese investors to bring their money home (and so sell foreign currencies and buy the Yen again). But another reason is the fiscal side. Japanese government debt remains over 200% of GDP. Interest rates just cannot rise too much without crippling government spending. Very high debt to GDP levels only really works if interest rates stay low.

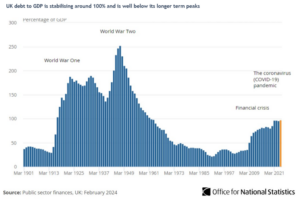

Contrast this to US and UK. UK debt to GDP is still high relative to recent history (just below 100%) but has actually been falling recently as higher inflation has lifted the GDP part of the equation. US debt to GDP is at 120% but is again below 2020 peaks.

This week saw more warmish inflation data out of the US. The US has a strong economy with inflation looking to be stabilising at around 1% above where the Fed would like it. This is not a bad place to be! And it is a very different world from the slowing economy and sharply rising inflation we saw in 2022. It is possible the US economy can learn to live with 5% interest rates. I would guess the number is lower for the UK (maybe 3%?) but even so the zero rate world that emerged post 2008 looks to be well and truly over.

Putting this together you have stable and higher interest rates for the US (and UK) versus Japanese interest rates that are low and have to stay low because of all the debt. As ever, it is currencies that adjust to balance this out. This means a lot of the recent Yen weakness looks structural and longer term to me. My guess is Japan is probably will stay a good holiday destination for a while! And if the Yen does get stronger, I’d expect fiscal dynamics to be part of the story.

Chris Brown, CIO

cbrown@ipscap.com

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.