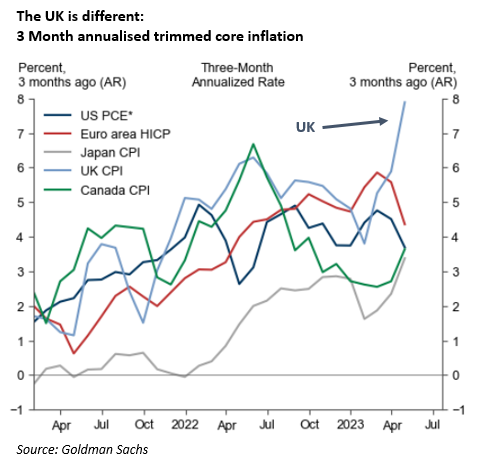

This week it is my favourite two topics, inflation and sex. On the first one, inflation numbers came out of the UK this week and they looked bad – and worse than other major developed countries – whichever way you cut it. Inflation numbers are often noisy, so economists try and strip out the volatile components (like food and energy) and focus on some measure of core inflation. In the chart below Goldman Sachs have done this and calculated 3-month average core inflation (February to April) for the UK and compared it to the rest of the developed world.

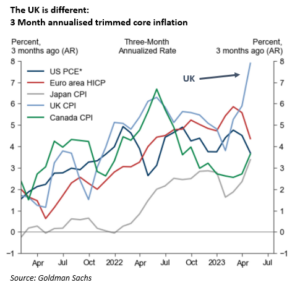

Now part of this is good news: the economy is strong and we are seeing no signs yet of the slowdown many feared. But this is also true in the US and Euro area, where core inflation is falling back in line with central banks’ targets. Something is going on in the UK that is different to everywhere else. This has pushed UK interest rates higher again. Longer term yields are back to levels last seen post the dramas of the Truss/Kwarteng mini-budget. UK base rates are now projected to hit 5.5% by November next year.

I find all this surprising. I have been expecting the economy to slow and inflation to fall in the UK for pretty much all the year. My hope is the UK is similar to the rest of the developed world, just lagging behind. If I am wrong, my one consolation is that, unlike 2022, markets are reacting more normally to these sorts of surprises. Stronger than expected growth has been good for equities, which have had a solid start to the year and this has helped offset recent bond losses. If and when the slowdown does eventually come, I would expect this to reverse and bonds to be a good hedge for client portfolios.

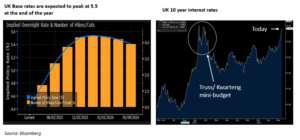

Wherever I look in the physical world (oil, energy, food), prices look to be falling. Cost inflation for food producers (PPI in the jargon) has already started to fall and food inflation will surely follow this down with a lag (see Chart below). As in September last year, this looks to be a good entry point for UK bond investors.

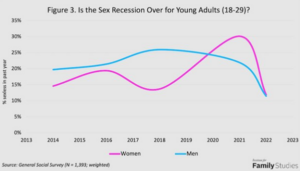

Finally, I have written before about falling fertility rates and the longer-term problems this may cause for South Eastern Asian countries, as they follow Japan’s demographic trends. You need about 2.1 births per female to keep a population stable. France (the best in Europe) is at 1.8, the UK is 1.6. Japan – which has been struggling with the impact of an aging population for a long time – is at 1.3. I write this because the data below for South Korea came out this week and their current fertility rate is 0.8. It is incredible to me that a country that has such an outsize cultural impact for the region – K-Pop and the Oscar winning Parasite for example – can have such acute demographic problems. I want to finish with some optimism on this, so below is the latest data from General Social Survey in the US. I just hope we see a similar pick up in Korea.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.