We had a question from a client this week on whether we thought sterling’s recent strength would continue. I’d guess this was in part inspired by the fact that UK interest rates rose to 4.5% (as expected) last week. The market now expects UK interest rates to peak between 4.75% to 5% in the second half of this year (so one or two more rate rises). This compares to expected peaks of 5.25% in the US and 3.75% in Europe. My short answer to our client’s question is that I hope sterling strength will continue, but I don’t expect it to.

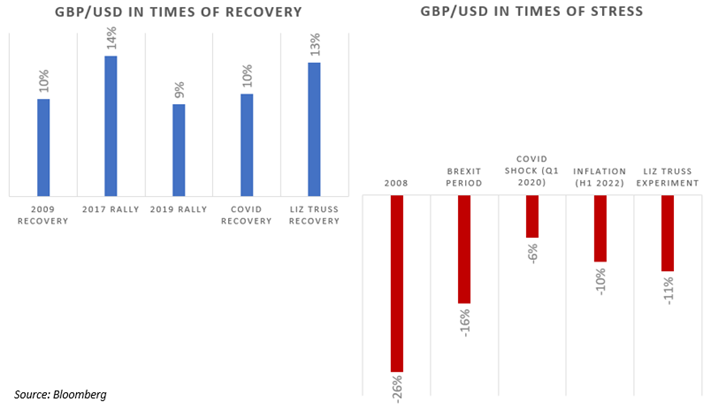

The main reason for hope is that rises in sterling normally go along with periods of economic recovery. And the opposite is also true: as you can see in the chart below sterling has weakened sharply in times of economic stress.

So, I think if you are bullish sterling here you should probably also be bullish the global economy. And indeed, as I have written here before, one of the real surprises in the last few quarters has been just how resilient the global economy has been to rising interest rates. If you had told me 18 months ago that UK interest rates would rise from 0% to 4.5% in just over a year, I would have thought that consumers and businesses would have been buckling under the weight of higher debt repayments. In fact, the UK economy remains strong. Consumer confidence is recovering from its 2022 lows and recent data has surprised on the upside in the UK – and we have been out-performing the US and Europe on this measure.

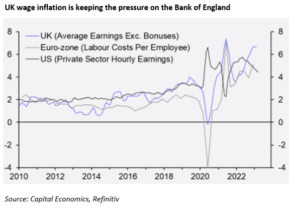

However, a couple of challenges for the UK remain. It has more reliance on mortgage debt that is exposed to rising rates than other developed markets. Europe has less mortgage debt in general and the US mortgages are generally 30-year fixed rate. We estimated last year that around 40% of the UK market was either on floating rate mortgages or had fixed them for two years or less. Mortgage rates have risen from around 1.5% to closer to 5%. When people’s post Covid savings are exhausted, we think this extra cost will inevitably eat into consumer demand and more so than in other countries. Secondly, wage data inflation looks stronger in the UK than elsewhere. This means the Bank of England will have to keep the pressure on for longer. It looks like the peak for US interest rates might already be in, whereas our peak might be nearer the end of this year.

Still, the UK economy has remained stronger than anyone might have reasonably expected a year ago. Long may it continue. Hope for the best but prepare for the worst is pretty sensible life advice. I also think it applies very well to the UK economy.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.