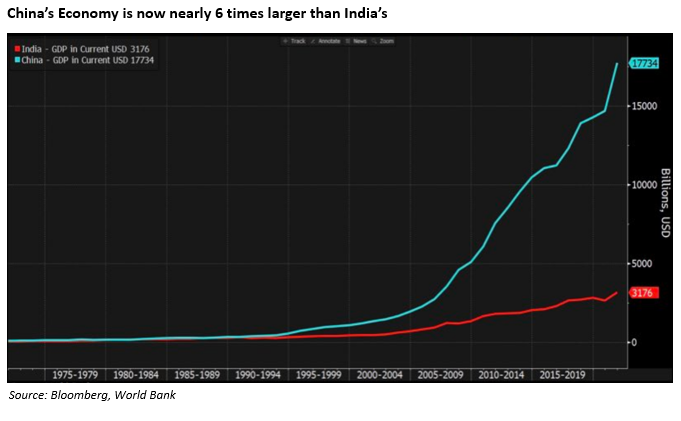

I take it we are all happy living in a democracy? When I was young there was a popular TV show called Citizen Smith whose star, Wolfie, was trying to turn Tooting communist. I haven’t been to Tooting for a while but I am pretty sure the Popular Front aren’t running things there today. I mention this because I was looking at the chart below last week which compares the GDP growth of (democratic) India with (notionally communist) China. The difference is staggering. China has grown at a faster rate, from a higher starting point, over the last 5, 10, 20 and 40 years. Since 1990 for example India has grown at a respectable 5.8% per annum (source). This is better than the UK (2.2% p.a.) and in line with Singapore (5.8%). China meanwhile has grown at a staggering 12.2% p.a. over that period.

There are, of course, doubts about the reliability of Chinese data but you cannot deny the growth in importance of the Chinese economy. The French luxury goods company LVMH announced 17% year on year sales growth last week driven mainly by strong growth in China. Tesla sells nearly as many cars in China as it does in all its other international export markets put together.

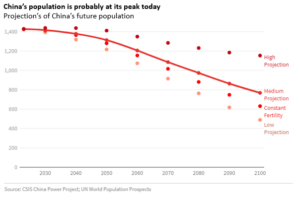

The interesting question as an investor is would you rather bet on China or India over the next 10 years? China faces three well known challenges – the so-called three Ds of Debt, Demographics and De-globalisation. China’s current problems of too much property debt combined with an aging population reminds me of Japan which, after an incredible run from the 1950s to the 1980s, has been a disappointing place to invest since the property bubble burst in 1990. China faces similar problems in its property markets and its demographics (especially after the impact of the one child policy) are arguably worse.

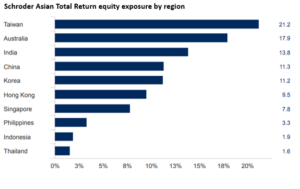

This all pushes me to think India’s future might yet be brighter than its past. That said, I am always very reluctant to bet against long term trends until they break. Our Asian equity exposure is currently run by regional experts at Schroders. Their most recent geographic allocation is below. You’ll see they have a larger allocation to India than China today (which is a bigger relative position than it might look given how much bigger the Chinese economy is).

This chimes with our overall positive take on India. That said, what if Wolfie Smith of Tooting was right after all? Well, we still have some exposure to China and many of the smaller Asian countries that depend on it for a large part on its growth. Geo-politics aside, strong Chinese growth is good for Chinese people and the region as a whole. Long may it continue.

For those that don’t know, I head the investment team at IPS Capital. Each week I highlight a few things that have come across my desk that I think are interesting and investment related. We always welcome dialogue so if you have any questions we’ll be happy to answer them.

Chris Brown

CIO

IPS Capital

cbrown@ips.meandhimdesign.co.uk

The value of investments may fall as well as rise and you may not get back all capital invested. Past Performance is not a guide to future performance and should not be relied upon. Nothing in this market commentary should be read as or constitutes investment advice.