We follow an active, multi-asset approach to investing. We believe that over the long-term this provides better capital protection and risk-adjusted returns. Our approach to diversification means we are unconstrained from the more traditional method of simply blending equities and bonds.

Asset Allocation

Deep understanding of the fundamental and technical aspects of each investment opportunity means that IPS is less concerned by short-term headlines and more interested in the longer-term risks and opportunities for client portfolios.

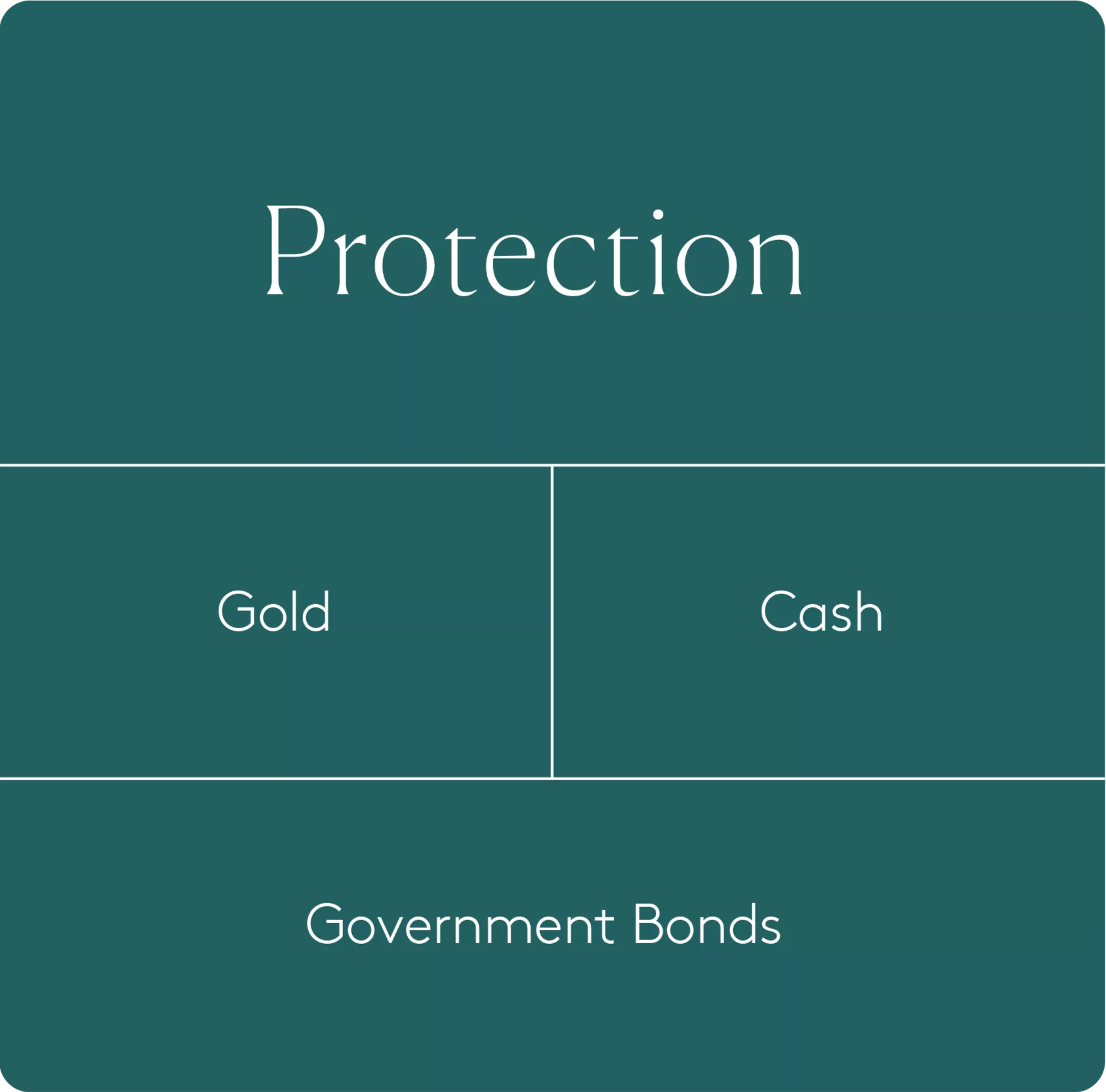

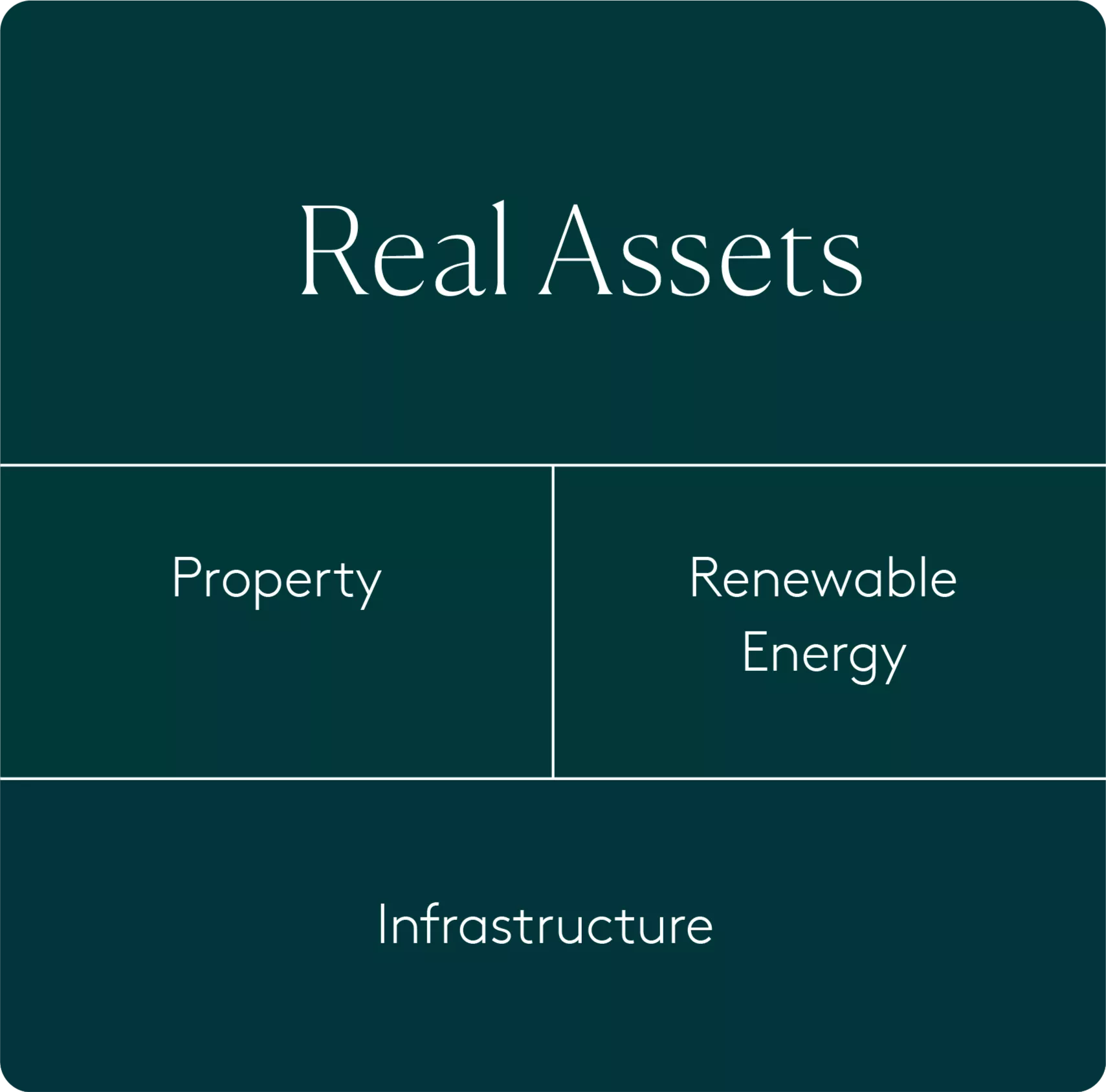

Our opportunity set covers nine asset classes. These are categorised into three key investment styles: growth, protection and real assets. IPS has incorporated institutional-strength economic, investment and fund research into its process by partnering with some of the world’s leading research houses. Our Investment Committee then debates each of our in-house investment ideas.

Opportunity Set

Portfolio Construction

When constructing a portfolio, we first determine the client’s upper and lower risk limits. These limits determine both the types of assets that will be selected and the proportion that they will account for in the portfolio. The assets are extensively researched and monitored and a comprehensive due diligence process is employed.

Our risk management system, IPS ART, is then used to carry out stress tests on the portfolio and monitor its compliance with its risk profile.

Investment Strategies

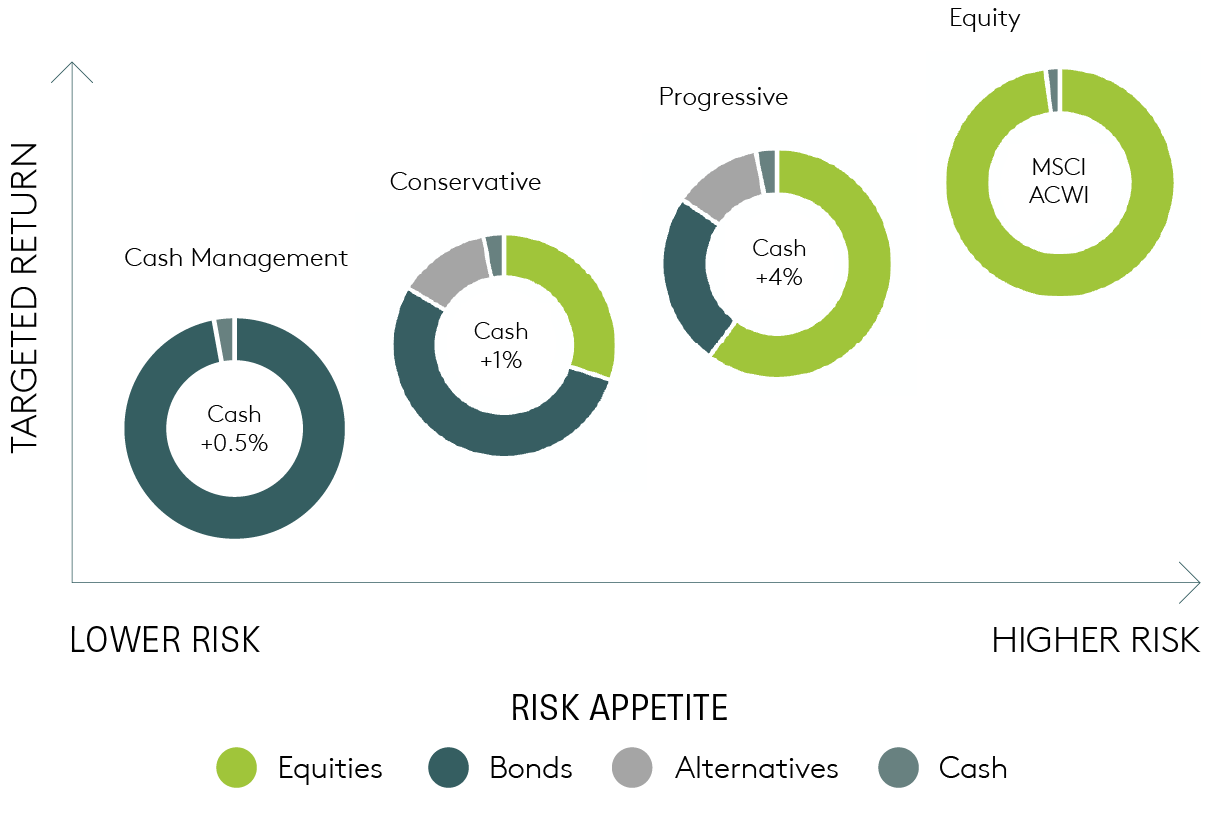

We combine our institutional and private client experience to provide genuinely diversified investment strategies with institutional investment standards – adding investments where appropriate to core portfolios to enhance our clients’ returns.

Our investment strategies are available in a range of risk levels depending on client need and tolerance. Each strategy can be modified to take into account client preferences or exclusions needed to incorporate bigger picture planning or tax considerations. Our strategies are also available in a range of currencies.

Shown is an example of our strategies that include, but are not limited to, Cash Management, Conservative, Progressive and Equity.

OUR APPROACH